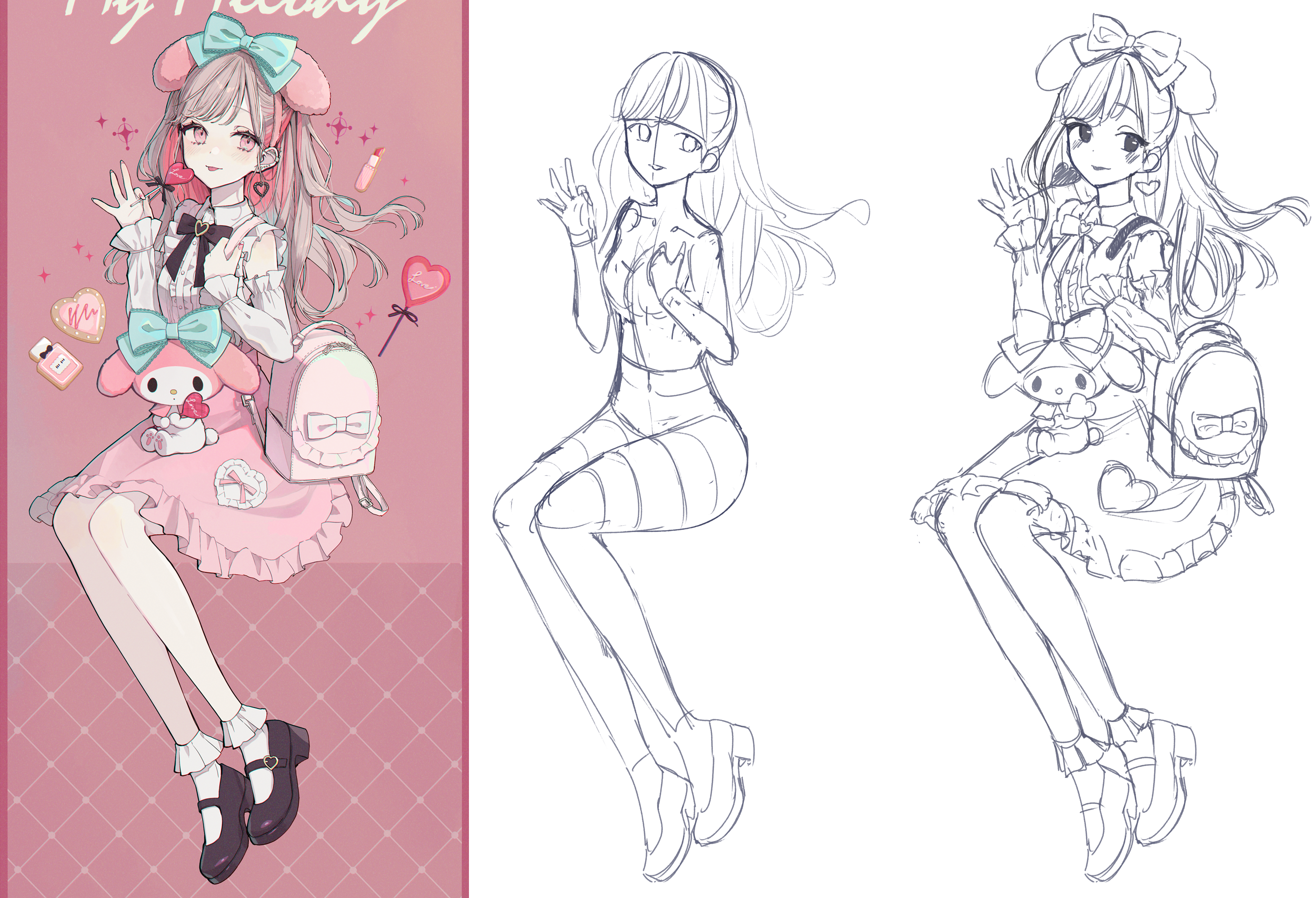

速寫 Day51

來源:赤倉

在6/23-6/26,

跟大學同學去宜花畢業旅行。

真的是累死了,

一直唱歌喉嚨好痛。

然後又每天聊天聊到一兩點。

因為疫情的關係大家好久沒有聚在一塊,

現在好不容易聚在一起,

反而已經是最後一次了。

畢業之際,雖然有許多不錯的回憶,

但心中真的還有許多滿滿的不捨。

之後照片整理整理後再寫一篇文章吧!

現在真的沒辦法。

一回來就好多東西要忙==

例如實習前要研讀的許多教程資料;

7/3要準備考的日檢N1;

或是日本交換線上課程準備要考期末;

更甚至最近家裡裝潢完成需要開始搬東西。或是要再去新竹領畢業證書之類的==

總之就是很多東西。

–

然後最近水電工、第四台、裝冰箱等等工人,

一直來,

我最近的下午完全沒辦法念書。

雖然覺得他們真的很累很辛苦,

可是……

我真的要開天窗啦!

啊啊啊啊啊啊啊!

然後還要碩士註冊前體檢,

插座還因為水電師傅接錯,

印表機不小心燒掉?

太多事了吧!

我真的要崩潰了喔?

日文總複習

- すら ─ 就連

- だに ─ 光是

- たにとも…ない ─ 就連1次、1秒…都沒有

- がてら ─ 順便

- かたがた ─ (正式) 順便

- かたわら ─ 另一方面

- ずくめ ─ 滿是

- まみれ ─ 渾身(負面)

- が早いか ─ 一…就…

- や否や ─ 一…就…

- そばから ─ 才剛…就…(負面)

- ~なり ─ 一…的同時

- ~んがために ─ 為了…

- ~とばかりに ─ 彷彿機會來了、像是在說…的樣子

- ~とばかりに ─ (程度很大)

- (に)~かのごとく(き) ─ 彷彿(強調,但沒實際做!)

- てしかるべき ─ (不滿)本來就應該

- べからず ─ 不能、禁止

- (ある)まじき ─ 身為…(的立場)是不能…的

- Aもさることながら…Bも ─ A不用說,但B也非常…(強調)

- はおろか ─ 不用說…就連(負面)

- にもまして ─ 比…更(以前)

- に越したことはない ─ 雖然這樣做比較好,但…

- には及ばない ─ 不必

- にはあたらない ─ 不值得

- までもない ─ 不必特地

- を皮切りに ─ …為開始

- を限りに ─ 1. …為最後 2. 盡全力

- をもって ─ 就是で(通常接時間後面)

- ばこそ ─ 正因為

- ならでは ─ 特有的

- あっての ─ 有著…(才有的)

- をおいて…ない ─ 除了…其他人都不能

- ~なり~なり ─ 都可以喔

- ~つ~つ ─ 重複

- ~であれ~であれ ─ 不管、無論

- ~といい~といい ─ 不管A還是B,全部都

- ~うが~うが ─ 不管A還是B(同種類),都與我無關

- ~うと~まいが ─ 不管A還是B(正反面),都與我無關

- ~うが~なかろうか ─ 不管A還是B,都可以…

- たところで ─ 就算(現在開始…) 也沒辦法…

- いかんだ ─ 根據

- をよそに ─ 不顧 (周圍的意見)

- をものともせず ─ 不顧 (糟糕的狀況)

- たるもの ─ 身為(…立場) 必須…

- ともあろうものが ─ (批評高位階的人)

- ゆえに ─ 因為

- と思いきや ─ 原以為…卻 (正面)

- といえども ─ 原以為…但 (不能)

- からある ─ (數量)以上

- からなる ─ 組成

- めく/めいた ─ 春、謎題、說教

- ぶる ─ 假裝、刻意

- てならない ─ 非常(殘念、擔心)

- てやまない ─ 無比(感激、願望)

- 極まりない ─ 極為

- の至り ─ 無比

- を禁じ得ない ─ 不禁

- に堪えない ─ 忍不住

- を余儀なくされる ─ 不得不

- ずにはいられない ─ 不由得、不得不

稍微的筆記

Deep Learning with Python - Chollet

- Optimization: the process of adjusting a model to get the best performance possible on the training data.

- Generalization: how well the trained model performs on data it has never seen before.

- Regulization: the process of fighting overfitting.

Preventing overfitting:

- Get more training data.

- Reduce the capacity of the network.

- Add weight regularization.

- Add dropout. (introducing noice)

–

Finding Alphas: A Quantitative Approach to Building Trading Strategies - Tulchinsky et al.

Introduction to Alpha Design

- Alpha design: A forecast of the return on each of the financial securities, to make predictions about future movements.

- Data \(\rightarrow\) (e.g. historical proces, volume, shares traded, etc.) \(\rightarrow\) Alpha \(\rightarrow\) Price Prediction

- The existence of alphas is a result of the imperfect flow of information among market participants with competing objectives.

- Rules in trading are called alphas.

- Cutting losses: Letting go of rules that no longer work.

- Applying all rules simultaneously is the key to success. No single rule can ever be relied upon completely, so it’s necessary to come up with a strategy for using rules simultaneously. (Some rule should be cut immediately when emergency happens)

Design and Evaluation

Alpha design

- Typically, an alpha is utilized as a component of a trading strategy, which converts the alpha’s predictions into actual trading decisions. The strategy also considers practical issues such as transaction costs and portfolio risk.

Alpha Types

- Intraday alphas: rebalanced during trading hours of the day.

(1) Rebalance at each interval. e.g. 1 min/5 min.

(2) Rebalance triggered by some events such as ticks/orders/fills or predefined events.

- Intraday alphas: rebalanced during trading hours of the day.

- Daily alphas: rebalance every day.

(1) Delay N: use data of N days ago.

(2) Delay 0 snapshot: use data before a certain time snapshot.

(3) MOO/MOC: alphas trade at market open/close auction session.

- Daily alphas: rebalance every day.

- Weekly/Monthly alphas: rebalanced every week/month.

Development of an alpha:

- Using public information by searching signals/patterns:

(1) Price/Volume.

(2) Fundamentals.

(3) Macro data.

(4) Text.

(5) Multimedia. (Extract text information from the video/audio). - Other information from which alphas are not derived directly but may be used to improve the performance of alphas:

(1) Risk factor models. (risk mitigation.)

(2) Relationship models. (lead or lag due to correlation.)

(3) Microstructure models. (real trading.)

Practical alpha evaluaion

- Run a simulation (backtest) to measure characteristics:

(1) Information ratio: The mean of the alpha’s returns divided by the standard deviation of the returns.

-> Measure Consistency.

-> which combined with the length of the observation peroid can be used to determine how confident we are to determine that the alpha is not some random noise.

(2) Margin: The amount of profit made by the alpha in the simulation divided by the amount of trading that was done.

-> Measure Sensitivity to transaction costs.

(3) Uniqueness: The maximum correlation of the alpha to others in the pool of alphas.

-> Lower correlation means more valuable alpha.

Develop an alpha:

- Collect information.

- Come up with an idea.

- Translate into a mathematical expression. (Positive alpha \(\rightarrow\) long position, vice versa.)

- Transform the raw expression by applying operations.

- Final robust alpha.

- Translate into positions in a financial instrument.

- Check for robustness, such as High In-sample / Good Out-of-sample Information Ratio, less fitting, small drawdown, etc.

Improving alpha:

- Risk mitigation: requiring our portfolios to be always long/short balanced within each industry.

- Relative size is more accurate as a predictor: Concept of rank.

- Using Decay: averaging alpha signal within a time window. (To reduce turnover.)

今日其他進度:

- 日文N1文法、N1題目

- 一堆的動畫

我會繼續努力的。