速寫 Day39

繼續練速寫。

–

今天終於出夜蘭啦~

而且很歐的完全沒歪

五萬顆石頭

總共抽出夜蘭命三

與若水精一

運氣真好~!

稍微的筆記

CFA ch32 Capital budgeting

Categories of Capital budgeting Projects:

- Replacement projects to maintain the business: whether the existing operations should continue. (not detailed)

- Replacement projects for cost reduction. (detailed)

- Expansion projects. (detailed)

- New product or market development. (detailed)

- Mandatory projects: involve safety-related or environmental concerns, and generating little revenue.

- Other projects: not easily analyzed or high-risk. (e.g. R&D)

Capital budgeting Principles:

- Decisions are based on cash flow, not accounting income.

<1> Sunk costs: costs cannot be avoided even if the project isn’t undertaken.

<2> Externalities: effects after the acceptance of a project.

<3> Cannibalization: negative externality.

<4> Conventional cash flow pattern: sign on the cash flows change only once.

-> Unconventional cash flow pattern may cause multiple IRR or no IRR problems because the project has cash outflows during its life.

- Decisions are based on cash flow, not accounting income.

- Cash flows are based on opportunity costs.

- The timing of cash flows is important.

- Cash flows are analyzed on an after-tax basis: The impact of taxes must be considered.

- Financing costs are reflected in the project’s required rate of return.

Affect

- Mutually exclusive: can accept either A or B, but not both.

- Project Sequencing: projects must be undertaken in certain order.

- Unlimited funds: can undertake all projects with expected return \(\geq\) cost of capital.

- Capital rationing: have constraints on the amount of capital.

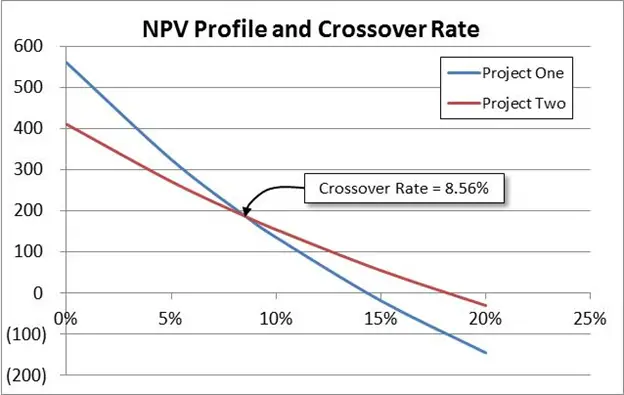

NPV

- NPV: sum of PV of all the expected incremental cash flows.

- IRR: the discount rate that makes \(NPV=0\).

- IRR decision rule:

If \(IRR>\) The required rate of return (or we can say firm’s cost of capital.)

-> Accept the project. - hurdle rate: The minimum IRR that a firm requires for a project to be accepted.

- The NPV method assumes that a project’s cash flows will be reinvested at the cost of capital, while IRR method assumes they will be reinvested at the IRR.

- If NPV and IRR methods give conflicting decisions for mutually exclusive projects, the NPV decision should be used to select the project.

Payback Period

- Payback period (PBP): number of years it takes to recover the initial cost of an investment.

- Discounted payback period: number of years it takes to recover the initial cost of an investment in PV terms.

- Profitability Index (PI): \(PI=\dfrac{PV\space of\space future\space cash\space flows}{CF_0}=1+\dfrac{NPV}{CF_0}\)

今日其他進度:

- 日文N1文法、N1題目

- CFA ch32

- 一堆的動畫

我會繼續努力的。