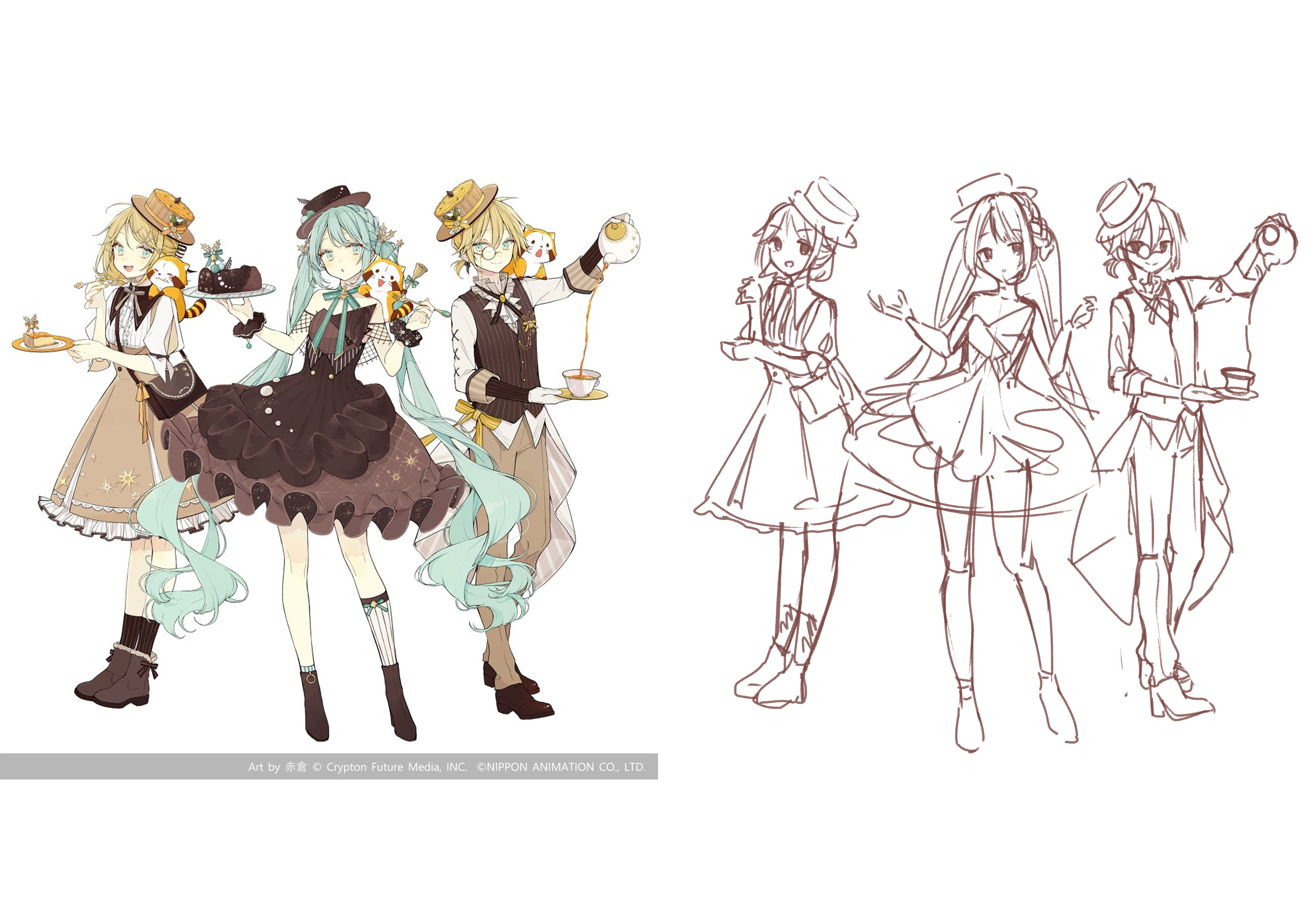

速寫 Day38

本來要畫次子安妮亞

但

底子不行

我不夠強

真的畫不出想要的感覺,

又不想玷汙(?

間諜家家酒這個好作品。

所以還是先繼續練習吧。

(而且真的是速寫,不是以往畫的很細的臨摹)

再不速寫效率太差了。

人體骨架的掌握度真的太低了。

希望能進步快一點啊><

–

為什麼昨天沒有畫畫念書呢?

因為覺得動畫荒,

所以重溫了果青

發現真的好好看,停不下來

於是就把三季全部看完了。我真的是個垃圾==

然後看完果青覺得還不夠滿足

又回去重溫不起眼,

這部,

直到現在在我心中

依舊有很大份量的

神作。

以上,回去重溫這兩部作品

是為了今後繼續努力

所必須要的休息。真的不是偷懶啦><

–

現在長大了再回去看,

真的會看到以前不曾注意到的細節。

或者是說,

以前不清楚的,

故事情節;

或是角色們的心情轉變。

但不管怎麼說。

好看就是好看,

這個結論至今依然不會改變。

身為「創作者」這件事,

依舊是我的憧憬、夢想。

因此,

我不會放棄練習畫畫。

我也不會放棄看動畫。

以及,放棄對ACG產業的追求。

–

但我是一個非常追求安逸的人。

也就是,我不會放棄一切去追求夢想。

說我懦弱也罷,

說我覺悟不夠也無妨。

但我無法冒著巨量的風險,

去做一件不知道有沒有回報的事情。

即便這件事情我非常喜歡。

但誠如前面所說,

我不會放棄我最喜歡的動畫。

因此,

雖然我依舊會繼續鑽研財務工程。

進入相關金融產業。

但在確保能維持生計的同時,

我也會在空餘時間繼續磨練自己的畫技。

直到賺盡能夠投資動畫產業的薪水。

希望能為ACG產業投注自己一份心力。

與創作者們一同分享熱情、喜悅。

這是我這風險趨避者所能夠接受

在面對現實與追求夢想中

兩者兼顧,

最好的辦法了。

即便會花上數年,

即便很有可能最終,

魚與熊掌不可兼得,

但我認為我將來,

對投身動畫產業的熱情不會有絲毫減少。

–

因為我,

真的喜歡「動畫」喜歡的不得了!

今日日文單字:

日文文法 ─ Q241-Q270

- AあってのB ─ 有A才有的B

- 1秒たりとも…ない ─ 連一秒都不能

- AならではのB ─ 只有A才特有的B

- お…ていらっしゃる ─ 就是敬語

- 寒いのなんのって ─ 非常寒冷

- ごときに/なんかに ─ 有時(負面、蔑視、看不起)

- てからというもの/してから ─ 從…開始(強調變化)

- よくAものだ ─ 難以相信

- よほどAないと ─ 如果不妥善的A(會變不好)

- AことなしにBない ─ 不做A的話,就無法B

- どうあれ ─ 不管

- Aはいざ知らず、B ─ A的話不知道,但B…

- もそこそこに ─ 急著

- 短時間もすれば ─ 只需要在(短時間)

- あわや ─ 眼看

- お気に召(め)す/気に入る ─ 有興趣(敬稱)

- 怖(こわ)さといったらない/とてもAだ ─ 非常(恐怖)

- 皮切(かわき)りに ─ 以…為首

- よう ─ 可能

- もっとも/当然(とうぜん) ─ 當然(能夠理解)

- っぱなし/1.したまま/2.ずと、つづけている ─ 1.照著 2.持續、維持

- かかっている ─ 取決於

稍微的筆記

CFA ch31 Introduction to corporate governance and other ESG consideration

Stake holder management:

- Annual general meeting: ordinary resolutions (決議) including approval of auditor and the election of directors.

- Extraordinary general meeting: special resolutions regarding a merger or takeover.

- Majority voting: most votes for each single board position is elected. (一股一票)

- Cumulative voting: cast all their votes (shares \(\times\) number of board position elections) for a single board candidate or divide them among board candidates. -> This helps minority stockholders to get more proportional representation on the board of directors. (非一股一票)

Board structure:

- One-tier board: includes both internal (also called executive directors) and external (also called non-executive directors, which have no other relationship with the company are termed indepedent directors.)

- Two-tier board:

1.Supervisory board (exclude executive directors)

2.Management board (made up of executive directors), is typically led by the company’s CEO. - One-tier board, the chairman used to be the company CEO. (Separation of the CEO and chairman has become more common recently.)

Board committees

- retains the overall responsibility for the various board functions.

- Audit committee: financial reporting function, accounting policies, and internal controls and audit function.

- Governance committee

- Nominations committee: propose qualified candidates.

- Compensation committee (Remuneration (報酬) committee): Besides types of compensation to be paid to directors and senior managers, also employee benefit plans and evaluation of senior managers.

- Risk committee

- Investment committee: monitoring the performance of a project.

Factors affecting corporate governance

- Staggered (交錯) board elections make a hostile takeover more costly and difficult.

Management of long-term risks

- ESG investing: use of environmental, socialm and governance factors in making investment decisions, also termed sustainable investing, responsible investing, or socially responsible investing.

- Approaches to integrating ESG factors into the portfolio management process:

1.Negative screening: excluding specific companies from consideration based on their practices regarding human rights, environmental concerns, or corruption.

2.Positive screening: A related approach, the relative/best-in-class approach, seeks to identify companies with the best ESG practices.

3.Full integration: inclusion of ESG factors in traditional fundamental analysis.

4.Thematic investing: investing in an attempt to promote specific ESG-related goals.

5.Engagement/active ownership investing: using ownership of company shares as a platform to promote improved ESG practices.

6.Green finance: producing economic growth by reducing emissions and better managing natural resource use. -> Green bonds, for which the funds raised are used for projects with a positive environmental impact.

7.Overlay/portfolio tilt strategies: to manage the ESG characteristics of their overall portfolios.

Others

- A proxy fight is an attempt to convince shareholders to vote a certain way.

- A tender offer (公開出價收購) can be made in the context of a takeover, whether hostile or otherwise.

- Reduced risk of default is among the benefits of effective corporate governance.

- Executive compensation and bonuses are consistent with the interests of shareholders if they are aligned with the company’s strategy.

- Positive screening doesn’t exclude any sectors but seeks to invest in the companies with the best practices.

- Negative screening typically excludes some sectors.

- Thematic investing refers to making an investment in a company or project in order to advance specific social or enviornmental goals.

今日其他進度:

- 日文N1文法、N1題目

- CFA ch31

- 一堆的動畫

我會繼續努力的。