速寫 Day28

來源:ASK

今天重看了白箱 (SHIROBAKO)

真的好好看。

本來對一成不變的生活有了一些疲態,

每天就是玩遊戲、念日文、念CFA、念FRM,和畫畫。

偶爾看一些youtube、實況、動畫等。

近期都在重複同樣的生活。

但一重刷完白箱後,

似乎又找回了,

當時決定為了夢想而努力的熱忱。

事實上,當時在準備推甄研究所的自傳時,

寫了我對財務工程有多大的興趣,

講得好像自己對未來想做的事有很明確的目標。

但是到底要從事甚麼工作,想過什麼生活,

到現在還是很模糊。

–

白箱亦是在闡述這樣的故事。

主線之一,就是在描寫:

主角到底期望未來的自己變成什麼樣子?

主角的夢想到底是什麼?

未來的目標又在何處?

主角僅僅是因為喜歡動畫,

而投身於動畫產業。

因此,一開始只是帶著

「想找到一個不需要專業能力,

也能對動畫產業有所貢獻」的想法。

沒有畫畫、配音、寫作的天分,或是專業能力

主角最終成為了「製作進行」,負責統籌所有部門的進度。

但每天僅僅是為了趕上期限而四處奔波。

勞心勞累的重複著周而復始的日常。

未來的自己究竟想成為什麼呢?

長期的目標究竟是什麼呢?

看著自己周遭的人們都有著明確的目標。

並仔細思考了,

為了這個目標,應該付出怎麼樣的努力。

但主角每天在處理許多瑣事。

又怎麼有時間能夠思考自己的未來呢?

畢竟在動畫產業,

沒有異常反而是異常。

任何一個突發狀況都會使動畫製作日程受影響。

「每天都如期進行日程表上的規劃」

這件事看起來本應該是再正常不過的事。

但在動畫產業,「如期進行」反而是非常不平常的。

就如同前面說的

各個期限逼得主角喘不過氣來。

又怎麼有時間思考自己未來想做什麼呢?

是的。

差不多是時候從更高處來眺望將來的時候了。

「我喜歡製作動畫。」

「也喜歡這些製作動畫的人們。」

那就簡單了。

「我希望今後也能一直製作動畫。」

–

所以事實上,真的沒什麼好說的。

我也喜歡畫畫。

也喜歡財務工程。

所以我也希望未來能持續畫畫,鑽研財務工程。

這樣,就夠了。

之所以在我之前寫的文章 ─ 動畫推薦 中

位於第一名的位置就可以知道

白箱這部作品在我心中有多大的份量。

當中有太多小故事

太多小支線能令人感同身受

從中又能看到許多

日本的職人精神。

「照片上有好多名人喔。」

「才不是名人呢。」

「我們只是因為喜歡,所以傻傻的在這個產業下堅持下去而已。」

劇中有太多這種小故事令人感動。

畢竟薪水又低、身心靈又很累。

那又為什麼會繼續待在動畫這個產業呢?

就是喜歡啊。

就是因為這份傻勁,

因而對動畫投注滿滿的熱情。

又因為這份對動畫的真誠,

對作品的追求,

感染了更多觀眾。

使更多人願意投身動畫產業,

星火相傳。

–

本來沒想打那麼多的。

但真的很好看,所以不知不覺就抒發了一下。

白箱真的是一部很棒的作品。

非常推薦大家。

今日日文單字:

- 平凡(へいぼん)極(きわ)まる ─ 超級普通

- 軽率(けいそつ)なこと極(きわ)まりない ─ 輕率至極

- 感激(かんげき)の極(きわ)み ─ 極為感動 (表示最高程度)

- 素晴らしい賞(しょう)をいただいで、光栄(こうえい)の至(いた)り ─ 得到這麼了不起的獎,光榮之至 (表達心情)

- 若気(わかげ)の至り ─ 年輕氣盛

- 贅沢(ぜいたく)の極み ─ 極度奢侈

- 遅(おそ)かれ早かれ飽(あ)きられる ─ 早晚會膩

- 良(よ)きにつけ悪(あ)しきにつけ ─ 無論好壞

- 消防士(しょうぼうし)は、周囲(しゅうい)の反対をものともせずに ─ 消防人員不顧周圍反對

- 子どもじゃあるまいし ─ 又不是小孩了

- N1にあるまじきN2 ─ 身為N1不該有的N2

- 学生を恐喝(きょうかつ)するとは、教師にあるまじき行為だ ─ 竟然恐嚇學生,是教師不該有的行為

稍微的筆記

ch39 Exotic Options:

- Plain vanilla options: generally traded on exchanges in fairly liquid markets.

- Exotic options: generally traded in the OTC markets and customized to fit a specific firm need for hedging.

- Package: is defined as some combination of standard European options on an underlying asset, such as bull, bear spreads, as well as straddles and strangles.

Transforming Standard American Options Into Nonstandard American Options:

- Bermudan option: restrict early exercise to certain dates.

- Early exercise can be limited to a certain portion of the life of the option. (lock out period)

- The options’s strike price may change.

Types of Exotic Options:

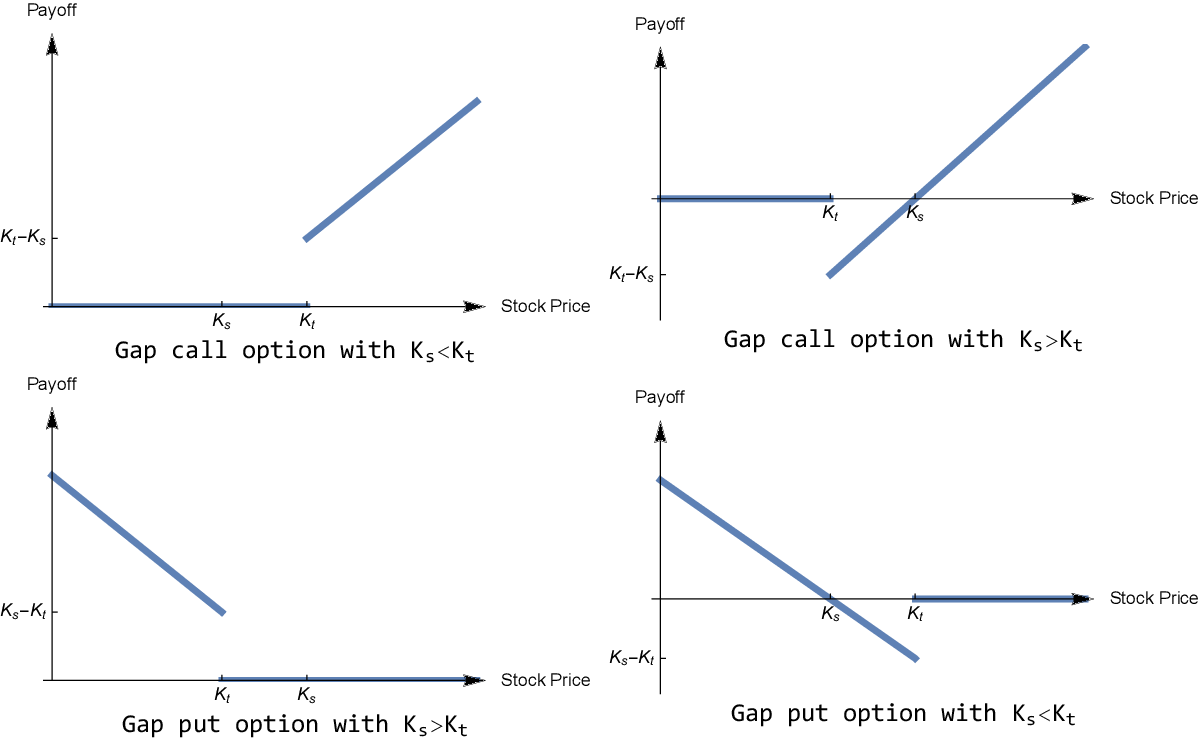

- Gap Options: a European option with two strile prices, \(X_1\) and \(X_2\), where \(X_2\) is sometimes called the trigger price.

- Gap Options: a European option with two strile prices, \(X_1\) and \(X_2\), where \(X_2\) is sometimes called the trigger price.

- Forward Start Options: are options that begin their existence at some time in the future.

- Cliquet Options: are structured as a set of forward start options that have specific guidelines on computing the exercise prices.

- Compound Options: are options on options. Such as call on a call, put on a put, etc.

- Chooser Options: allows the buyer choose whether the option is a call or a put after a certain amount of time has elapsed (過去).

- Barrier Options: are European options whose payoffs and existence depend on whether the underlying’s asset price reaches a certain barrier level over the life of the option.

<1>. Down-and-out call (put): A standard option that ceases to exist if the underlying asset price hits the barrier level, which is set below the current stock value.

<2>. Down-and-in call (put): A standard option that only comes into existence if the underlying asset price hits the barrier level, which is set below the current stock value.

<3>. Up-and-out call (put): A standard option that ceases to exist if the underlying asset price hits the barrier level, which is set above the current stock value.

<4>. Up-and-in call (put): A standard option that only comes into existence if the underlying asset price hits the barrier level, which is set above the current stock value.

– Characteristics: vega, the sensitivity of an option’s price to changes in volatility, is always positive for a standard option but may be negative for barrier option.

– For instance, Increased volatility on a down-and-out and up-and-out doesn’t increase value because the closer the underlying gets to the barrier price, the greater the chance the option will expire. That is, there’s discontinuity in the payoff profile.

- Barrier Options: are European options whose payoffs and existence depend on whether the underlying’s asset price reaches a certain barrier level over the life of the option.

- Binary Options: pay only one price at expiration if the asset value is above the strike price. The term binary means that the option payoff has one of two states, which results in payoff discontinuity.

<1>. Cash-or-nothing call (put):

<2>. Asset-or-nothing call (put):

- Binary Options: pay only one price at expiration if the asset value is above the strike price. The term binary means that the option payoff has one of two states, which results in payoff discontinuity.

- Lookback Options: whose payoffs depend on the max or min price of the underlying asset during the life of the option.

<1>. Floating lookback call: pays the difference between the expiration price and the minimum price of the stock over the horizon of the option. -> Allows the owner to purchase at its lowest price.

<2>. Floating lookback put: pays the difference between the expiration price and the maximum price of the stock over the time period of the option. -> Allows the owner to sell at its highest price.

<3>. Fixed lookback call: final stock price in the vanilla option payoff is replaced by the maximum price during the option’s life.

<4>. Fixed lookback put: final stock price in the vanilla option payoff is replaced by the minimum price during the option’s life.

- Lookback Options: whose payoffs depend on the max or min price of the underlying asset during the life of the option.

- Asian Options: payoff profiles are based on the average price of the security over the life of the option. -> Asian options are cheaper than regular options and could be more effectively used for hedging due to less volatile of the average price.

- Exchange Options: to exchange one asset for another.

- Basket Options: to purchase or sell multiple securities.

- Volatility Swaps: exchanging a prespecified fixed volatility for a realized volatility.

- Variance Swaps: exchanging a prespecified fixed variance rate for a realized variance rate. Variance is simply the square of the volatility rate, but variance swaps are easier to price and hedge because they can be replicated using a collection of call and put options.

- Static Option Replication: an approach in order to hedge positions in exotic options.

今日其他進度:

- 日文N1文法、N1題目

- FRM ebook ch39

- 一堆的動畫

我會繼續努力的。