速寫 Day27

來源:むっしゅ

今天一直下雨啊==

不然想去買公寓鹽酥雞配啤酒的

放縱DAY

結果今天也沒發生什麼大事。

最有趣的應該是LNG了

真的快笑死

今日日文單字:

- ~でも差(さ)し支(つか)えない/ありません ─ ~也沒關係

- もし差し支えないようでしたら ─ 如果沒什麼影響的話

- 用心(ようじん)するに越(こ)したことはない ─ 小心為上 (比小心更重要的事不存在)

- 安ければ安いに越したことはない ─ 能便宜當然便宜最好

- 数(かぞ)えればきりがない ─ 數也數不完

- Nを禁(きん)じ得ない ─ 不禁感到N

- Nを余儀(よぎ)なくされた ─ 不得不N

- Vる嫌(きら)いがある ─ 往不好的傾向

- 彼は考えすぎる嫌いがある ─ 最近想的總有點多

- 若者は協調性(きょうちょうせい)に欠(か)ける嫌いがある ─ 年輕人較為缺乏團隊精神

- Vる始末(しまつ)だ ─ 最終V了

稍微的筆記

ch37 Properties of Options

Formula

- \(C=Se^{-qt}N(d_1)-Ke^{-rt}N(d_2)\)

- \(P=Ke^{-rt}N(-d_2)-Se^{-qt}N(-d_1)\)

- An increase in the dividend (q), a lower risk-free interest rate, and a lower volatility of the price of the underlying stock will all decrease the value of a European call option.

- After a stock split, both stock price and the strike price will be adjusted, so the value of the option position will be the same.

Pricing Bounds:

- Upper bounds: \(c\leq S_0 \space and\space C\leq S_0\); \(p\leq PV(X)\space and \space P\leq X\)

- Lower bounds for European Calls on Non-Dividend-Paying Stocks: \(c\geq max(S_0-PV(X),0)\)

- Lower bounds for European Puts on Non-Dividend-Paying Stocks: \(p\geq max(PV(X)-S_0,0)\)

- Put-Call Parity: \(c-p=S_0-PV(X)\)

- Lower bounds for American Calls on Non-Dividend-Paying Stocks: \(C\geq c\geq max(S_0-PV(X),0)\)

- Lower bounds for American Puts on Non-Dividend-Paying Stocks: \(P\geq max(X-S_0,0)\)

- Put-Call Parity American version: \(S_0-X\leq C-P\leq S_0-PV(X)\)

Pricing Bounds with the impact of Dividends:

- \(c\geq max(S_0-D-PV(X),0)\)

- \(p\geq max(D+PV(X)-S_0,0)\)

- Put-Call Parity: \(p+S_0=c+D+PV(X)\)

- Put-Call Parity American version: \(S_0-X-D\leq C-P\leq S_0-PV(X)\)

NOTE:

- When the dividend is large enough, American calls might be optimally exercised early.

- Fiduciary call(信託買權): a combination of a pure-discount (zero coupon) riskless bond and a call.

- Protective put: a share of stock together with a put option.

ch38 Trading Strategies:

- Protective Put

- Covered Call: purchase of stock + sale of call.

- Principal protected notes (PPNs): are securities that are generated from one option.

- Bull/Bear spread

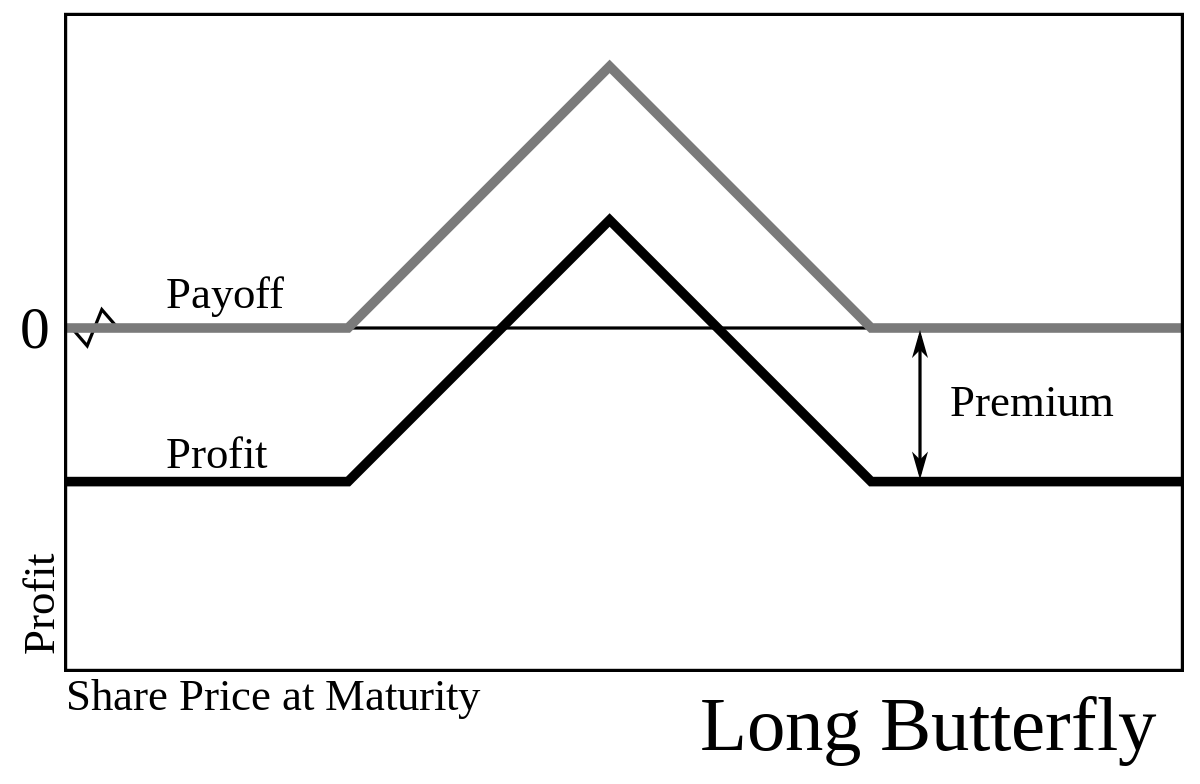

- Butterfly spread: involves purchase or sale of three different call options.

\(Long\space X_1\space and\space X_3,\space and\space Short\space Two \space X_2\)

- Butterfly spread: involves purchase or sale of three different call options.

- Calender Spreads: created by transacting in two options that have the same strike price but different expirations.

- Calender Spreads: created by transacting in two options that have the same strike price but different expirations.

- Diagonal Spreads: similar to a calendar spread, but a diagonal spread can have different strike prices.

- Box Spreads: a combination of a bull call spread and a bear put spread.

- Box Spreads: a combination of a bull call spread and a bear put spread.

- Straddle: purchasing a call and a put with the same strike price.

- Straddle: purchasing a call and a put with the same strike price.

- Strangle: similar to a straddle, except that the options purchased are slightly out-of-the-money. (different strike price.)

- Strangle: similar to a straddle, except that the options purchased are slightly out-of-the-money. (different strike price.)

- Strip: purchasing two puts and one call with the same strike price and expiration.

- Strap: purchasing two calls and one put with the same strike price and expiration.

- Strap: purchasing two calls and one put with the same strike price and expiration.

今日其他進度:

- 日文N1文法、N1題目

- FRM ebook ch37 38

- 一堆的動畫

我會繼續努力的。