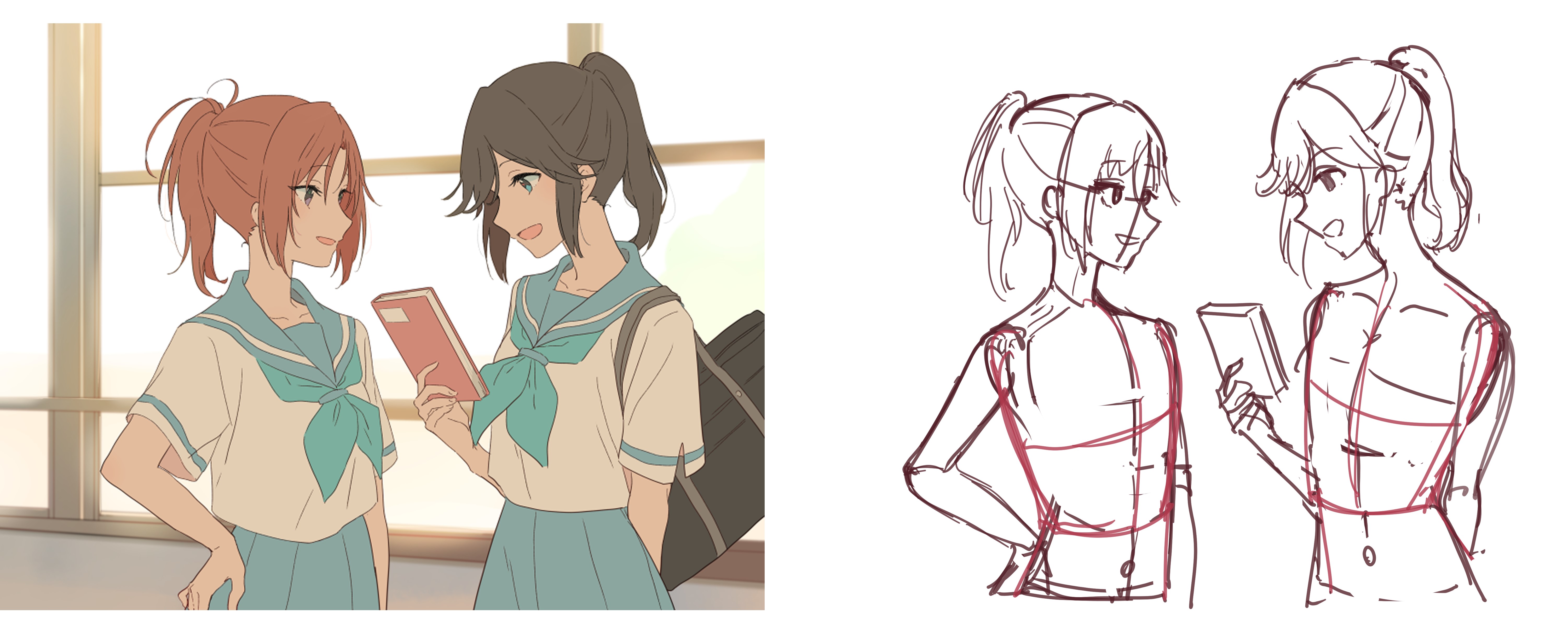

速寫 Day26

來源:赤倉

來源:むっしゅ

恭喜PSG晉級~

最近uber eat用了優響方案

第一個月免費

所以我打算快到期前

再解除方案

爽薛

西西><

然後今天吃了鴨肉許

超飽==

今日日文單字:

- 冗談(じょうだん)はさておき ─ 先不開玩笑了,…

- 結果(けっか)はどうあれ、悔(く)いはない ─ 不管結果如何,我不後悔。

- どんな理由(りゆう)であれ ─ 無論何種理由

- Nはおろか~(も/まで/すら) ─ 別說N了,連…

- Nなら(は)いざ知らず ─ N的話不知道

- 嘆(なげ)くにはあたらない ─ 用不著唉聲嘆氣

- 想像(そうぞう)に難(かた)くない ─ 不難想像

- 願(ねが)っ/祈(いの)っ/信(しん)じ/尊敬(そんけい)てやまない ─ 無比祝福、祈願、相信、尊敬

- 汚職(おしょく)でなくてなんだろう ─ 不是貪汙是甚麼

稍微的筆記

ch36 Option Markets

- out-of-the-market: Intrinsic value = 0

Underlying Assets:

- Stock options: Typically exchange-traded and American-style options. Each optoin contract is normally for 100 shares of stock.

- Index options: Typically European-style options and are cash settled. Also, Index options can be found on both OTC and exchange-traded markets.

- ETF options: Typically American-style options and utilize delivery of shares rather than cash at settlement.

Option Expiration:

- actual day of expiration is the third Friday of the expiration month.

- Before the third Friday of the expiration month, maturities are current month, the following month, and the next two months in the 3-months circle.

- After the third Friday of the expiration month, maturities are next month, the month after that, and the next two months in the 3-months circle.

- be dictated by ─ 主宰

- increments ─ 增量

Nonstandard Products

- FLEX options: flexible exchange options are exchange-traded options on equity indices and equities that allow some alteration of the options contract specifications.

- Asian options: generate payoffs calculated on the average price of the underlying for the life of the option.

- Cliquet options: generate payoffs calculated as the sum of the monthly capped return earned by the asset.

Margin Requirements

- Option with maturities of nine months or fewer cannot be purchased on margin (保證金開槓桿). This is because the leverage would be too high.

- Uncovered calls (those in which the writer doesn’t own a position in the underlying asset.)

Other Option-Like Securities:

- Warrants (認股權)

- Employee stock options

- Convertible bonds

Conclusion:

- Position limits are usually the same as exercise limits.

- Writing covered calls doesn’t require any margin.

- Options are adjusted for stock dividends (stock split), not cash dividends.

For instance, if a stock experiences a b-for-a split, the number of shares underlying the option \(\times \space \dfrac{b}{a}\), and the strike price becomes \(\times \space \dfrac{a}{b}\) .

- Options are adjusted for stock dividends (stock split), not cash dividends.

- LEAPS (Long-term equity anticipation securities) expire on the third Friday of January of each year

今日其他進度:

- 日文N1文法、N1題目

- FRM ebook ch36

- 一堆的動畫

我會繼續努力的。