速寫 Day25

來源:赤倉

頂上戰爭

統動大戰

我還在看

今日日文單字:

- 見るに堪(た)えない ─ 不忍直視

- NというN ─ 強調

- Nぶる/ぶって/ぶったN ─ 裝作

- Nぶり ─ 從…

- Vる/Nだに ─ 光是

- こととて ─ 因為…

- 昔(むかし)ほど恐れるに足らない ─ 與以前相比不足為懼

- ご心配には及びません ─ 不必擔心

稍微的筆記

ch34 Pricing Financial Forwards and Futures:

Value of a Forward Contract:

- The forward price at every moment in time is computed to prevent arbitrage, the value at inception of the contract must be zero.

- If we denote the obligated delivery price after inception as K, then the value of long contract on an asset with an annual dividend yield of q is computed as: \(\dfrac{S}{(1+q)^T}-\dfrac{K}{(1+r)^T}\)

- If interest rates rise, then the underlying assets will fall in value. That is, there’s a loss on both futures and forwards contracts. However, with futures, a loss from an asset price decrease will be recognized immediately (due to daily settlement). In that regard, a forward contract is more desirable and would be price higher.

ch35 Commodity Forwards and Futures:

- Commodities prices tend to be mean-reverting.

Energy:

- Crude oil: easy to transport.

- Natural gas: is expensive to store.

- Electricity: is not generally a storable commodity. Due to that, arbitrage opportunities do not exist with electricity. In other words, futures prices on electricity can be much more volatile than financial futures.

Commodity Arbitrage:

- The makets for those commodities that are storable are called as carry markets.

- cash-and-carry arbitrage:

- \(F_{0,T}=(S_0+U)\times(1+r)^T\), where U implys storage costs.

- \(F_{0,T}=(S_0-I)\times(1+r)^T\), where I implys income(or we can say the storage costs are negative.)

- The commodity forward price with an active lease market is expressed as: $$F_{0,T}=S_0\times[\dfrac{(1+r)}{(1+\delta)}]^T$$, where \(\delta \) implys lease rate.

- The forward price including a convenience yield is calculated as: $$F_{0,T}\geq (S_0+U)\times[\dfrac{(1+r)}{(1+Y)}]^T$$, where Y implys annualized convenience yield.

- Convenience Yield (便利孳息) : The nonmonetary benefit of holding excess inventory. (which is only relevant (有效) when a commodity is stored. e.g., in a carry market.)

- Lease rate is similar to the dividend payment in a financial forward, which can be negative.

Futures Prices and Expected Spot Prices:

- \(E(S_T)=F\dfrac{(1+X)^T}{(1+r)^T}\), where X implys expected return on futures position.

- Recall that Systematic risk is a function of the correlation btw the return on the market versus the underlying asset. If the correlation is positive, then X should exceed r.

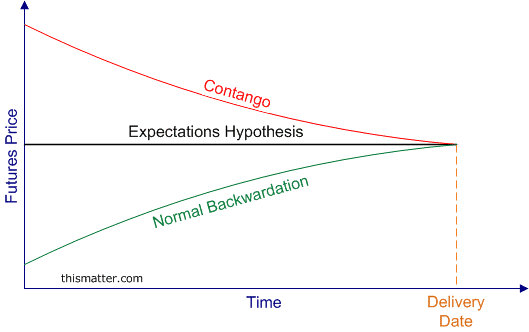

- Normal backwardation (正常倒退): If the correlation is positive, X > r, thus \(E(S_T)>F\).

- Contango (期貨升水): If the correlation is negative, \(E(S_T)<F\).

今日其他進度:

- 日文N1文法、N1題目

- FRM ebook ch34 35

- 一堆的動畫

我會繼續努力的。